With every generation and decade comes a new problem, right? Unfortunately, that is the world in which we live. The good news is, there are solutions to these problems. Let’s first quickly address some of the biggest problems retirees may face today…

1) Lack of pension

Over the past several years, the use of traditional pensions in retirement keeps getting lower and lower. In today’s economy, fewer employers are offering pensions to their employees. If you’re retired or retiring soon, it is likely you don’t have a pension either. You might not have the luxury your parents had when they retired. Being able to comfortably retire knowing you have permanent, reliable income from a pension is not really an option today.

Because of this shift in retirement planning, people are worried about not having a predictable and reliable source of income. People retiring want to ensure that their living expenses are covered once they retire. Once upon a time, a pension offered them this comfort and reassurance. Another sad truth is that, for many people retiring, Social Security will not be nearly enough to cover everything they need it to cover.

What does this mean for you?

Well, here’s something interesting… Pensions weren’t much of a necessity back in the 80’s and 90’s. From 1982-2000, the S&P was up 1000% and the NASDAQ was up over 2000%! That’s crazy, right? People who were retiring during that time weren’t very concerned about pensions. It didn’t matter as much if they did or did not have one going into retirement. Why would it matter, when they were making stock market returns that were in the double digits?

What’s the problem with that mentality? It all boils down to the good old saying, “what goes up, must come down.” I hate to be cliché, but it’s true. Just look at what happened in the stock market after those booming years. Nobody knows what the stock market will do. It is NEVER a guaranteed thing, and do you really want to subject your livelihood to the erraticism of the stock market? Do you want the stock market to be the one determining how you live your life in retirement? No, YOU want to be the one determining that. You want to be certain that your living expenses are covered no matter what.

Well, you can do that without the use of a traditional pension. But let’s first touch on the other two problems you may be facing in retirement.

2) Running out of money

This problem ties in with the previous problem, the lack of a pension. People retired or soon to retire are very concerned that they may run out of money in retirement. They are worried that what they have saved during their working years isn’t enough to sufficiently get them through retirement, worry-free.

People want security in retirement, and rightfully so. They want an income that is guaranteed to always be there no matter what happens in the stock market. Who wouldn’t want that? Because of this fear people have, they are sometimes forced to work longer than they had originally intended, thus putting off their retirement.

For others, they are forced to monitor every last dime they spend in retirement to ensure they don’t run out. That’s no way to retire! Isn’t retirement supposd to be about relaxation and visiting your grandchildren? It may seem like a fantasy to some, but it’s a reality for many (the ones who take the right approach to retirement).

3) Inflation

This problem ties in with the first and second one we just discussed. Inflation is a huge problem people are facing in retirement. People are worried that their retirement income won’t be able to keep up with the rising costs.

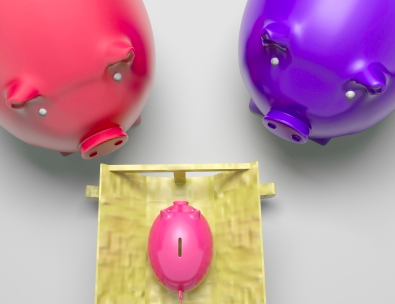

Well, what if I told you there is something out there that can solve ALL three of these problems and more? Moreover, many people would argue that this product is better than the traditional pension.

It’s like a modern-day pension, designed to keep up with modern-day problems.

What is the name of this product? A fixed indexed annuity. I know you’ve read or have been told about it before. What you may not have been told is exactly how to use this in your overall retirement plan. Another thing you might not have been told is that the fixed indexed annuity isn’t for everyone! But, if it does work for you and your situation, it could quite possibly be the best thing to ever happen to you.

I’ve figured out a strategy to use the fixed indexed annuity, sometimes coupled with something else, to give you the MOST income you can possibly receive with what you’ve saved over the years.

Let’s have a quick chat to see if this is even something worth exploring for you. If not, it’s no biggie and we can move on. If it is, then I’ll be happy to show you the details of the plan. Just give me a call at 1-352-561-4571. You can also schedule yourself on my calendar, right on this page. Just look to the right, find the button that says “schedule strategy session,” and you’ll be on my schedule in no more than 30 seconds!